The latest TradeView Live episode brought together Kyle Henderson, CEO & Co-Founder of Vizion, Ben Tracy, Head of Strategic Business Development, and Daniel Banes, Advisor and Trade Compliance Expert, for an in-depth look at the new currents shaping global trade.

From tariff truces to port congestion, the discussion explored how real-time shipment data reveals structural changes in trade patterns long before they surface in official reports. Using the TradeView platform, the team analyzed container bookings, export controls, and supply-chain rerouting to uncover where global trade is heading next.

Watch the full episode on YouTube

USTR–China Tariff Truce: A Pause That Repositions Supply Chains

TradeView data shows China → U.S. bookings surged into late September as shippers rushed to move freight ahead of the planned USTR port and vessel fees, then dropped sharply during Golden Week. The newly announced one-year tariff truce could set the stage for a rebound in the coming weeks, but early booking data has yet to show the impact.

“This isn’t a return to the old trade order. It’s a rebalancing moment,” said Kyle Henderson.

Daniel Banes added that governments are increasingly using sanctions, tariffs, and export controls as “levers of influence,” creating real-time ripple effects across sourcing and compliance strategies.

TradeView weekly highlights:

- Global bookings (+3% YoY) remained steady leading into the truce announcement.

- U.S. imports (-2% YoY) showed moderate stabilization after a soft September.

- China → U.S. bookings dipped during Golden Week following September’s pre-tariff surge, with a rebound expected in early November.

-06.png)

Argentina’s Economic Rebound: A V-Shaped Recovery Takes Hold

Following months of austerity under President Javier Milei, Argentina’s containerized exports now exceed both 2023 and 2024 levels. Imports remain constrained, but outbound trade driven by soybean meal, lithium, and wine has strengthened the country’s trade balance.

“Container flows are often the first place you see a recovery take shape, well before GDP numbers catch up,” said Daniel Banes.

TradeView data indicates an 11.4% quarter-over-quarter increase in export TEUs since mid-2025, signaling that real-time shipment data can reveal recovery trends well ahead of official macro forecasts.

For a detailed breakdown of Argentina’s transformation, including the policy reforms, trade-balance shift and container-trade impact, see our blog: Argentina’s Economic Transformation Under Javier Milei: From Crisis to Opportunity (2023-2028) by Kyle Henderson.

Argentina Imports (2023-2025)

*Interactive: Scroll or hover to see TEU value for each cooresponding year

Argentina Exports (2023-2025)

South Korea: Export Control Coordination and Supply Chain Transparency

The new U.S.–South Korea trade agreement highlights growing alignment on export controls and technology-sector resilience. During the episode, Daniel Banes explained that compliance monitoring has evolved from static list screening to network-level visibility that tracks company ownership, supplier relationships, and ultimate end use.

“The visibility now extends well beyond your direct customer,” said Banes.

While most South Korea → U.S. trade lanes remain steady year over year, machinery exports (HS 84) show a clear downtrend. Weekly volumes have fallen from over 1,100 TEUs in early 2024 to around 625 TEUs in late 2025, suggesting a gradual shift from heavy manufacturing toward more advanced, higher-value production.

South Korea to US (Machinery - HS Code 84, 2024 vs 2025)

*Interactive: Scroll or hover to see TEU value for each cooresponding year

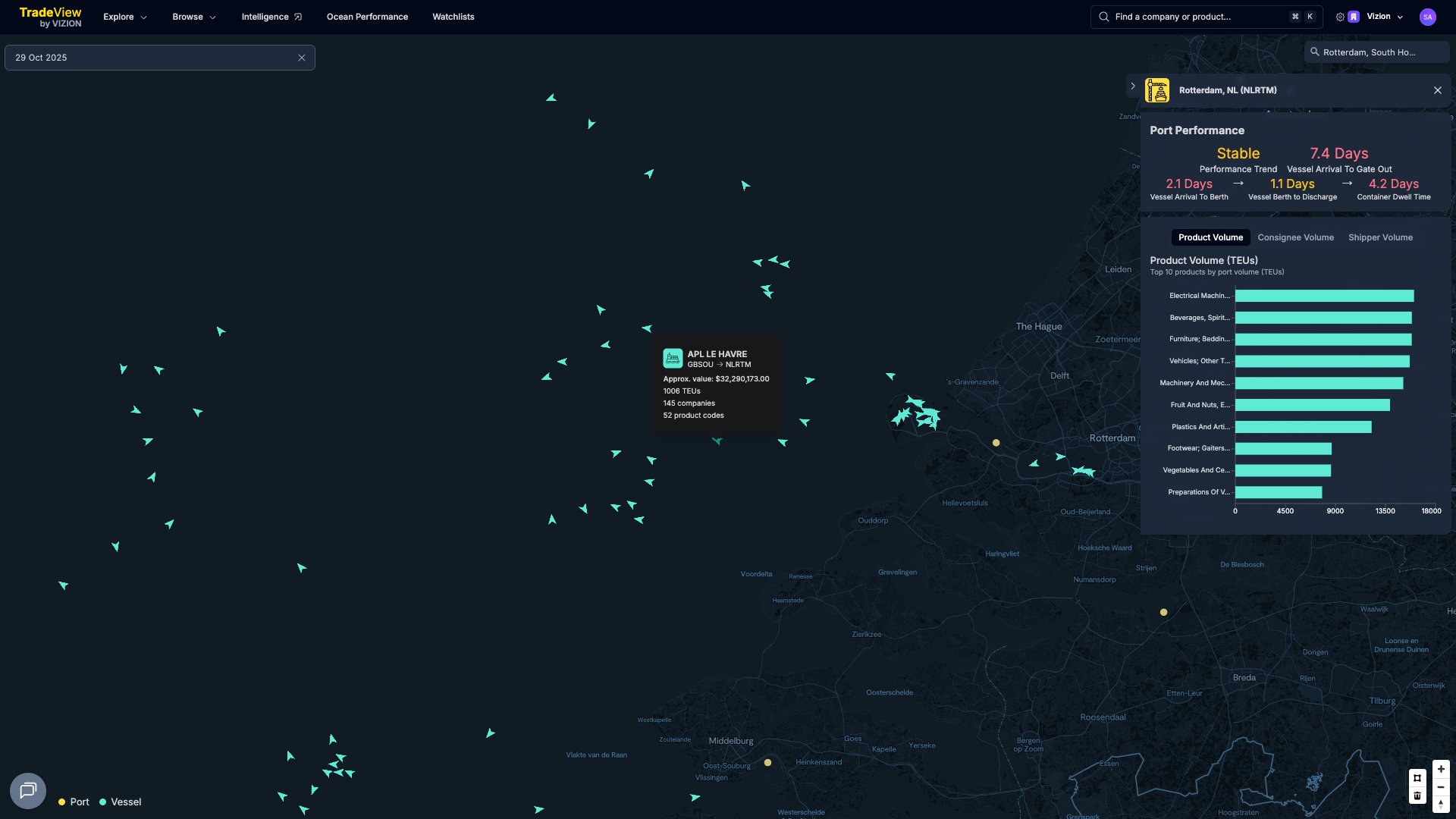

Northern Europe Congestion: Rotterdam’s New Normal

TradeView Performance data shows that port congestion in Northern Europe remains persistent, particularly at Rotterdam:

- Average wait time to berth: 2.1 days

- Average dwell time on land: 4.2 days

Labor strikes and terminal bottlenecks are contributing to delays that extend beyond one week from vessel arrival to container exit.

“If your vessel arrives today, expect more than a week before that container leaves the port,” Henderson noted.

Southeast Asia’s Surge: Cambodia Steps Up

Among Southeast Asian exporters, Cambodia has become the standout performer. TradeView data shows weekly TEU volumes rising from below 5,000 in 2023 to more than 15,000 in 2025.

Key factors behind the surge include:

- The shift away from China due to tariffs and forced labor restrictions (UFLPA)

- Increased foreign investment in textile and footwear manufacturing

- Regional and bilateral trade deals under RCEP, China, Korea, and UAE

“Once companies form new supplier relationships, it’s hard to turn back,” said Henderson. “Cambodia has become a China plus one anchor for risk diversification,” added Banes.

Cambodia to US Weekly Bookings (2023-2025)

*Interactive: Scroll or hover to see TEU value for each cooresponding year

Rare Earth Minerals: When Trade and Technology Collide

After China tightened export controls on rare earth minerals earlier this year, U.S. imports fell sharply. Now, as Beijing eases restrictions, TradeView data shows an early rebound in shipments.

“Rare earths are where trade and industrial policy collide,” said Henderson. “They’re a barometer of manufacturing power.”

Weekly containerized shipments of neodymium and dysprosium from China to the U.S. are projected to recover to 500–600 TEUs by year-end, returning to late 2024 levels.

China to US (Rare Earth Minerals - HS Code 25)

*Interactive: Scroll or hover to see TEU value for each cooresponding year

A Global System in Realignment

Across all regions, TradeView data reveals a global trade system in realignment rather than retreat.

- Argentina’s export-led rebound shows early signs of macro recovery.

- South Korea’s data underscores high-tech stability amid geopolitical tension.

- Cambodia’s climb highlights the durability of diversification strategies.

“These shifts aren’t temporary,” said Henderson. “They represent a permanent reshaping of where and how goods move.”

Get Ahead with Early Trade Intelligence

Vizion’s TradeView platform gives you live visibility into:

- Booking trends by country, product type, HS code, or commodity

- Changes by country or port

- Shipment behavior by consignee, shipper, and logistics provider

👉 Interested in TradeView? Request access or schedule a demo directly below.

%20(78).png)

%20-%202026-01-22T154931.625.png)

%20-%202025-12-03T153209.004.png)

%20-%202025-12-03T102433.766.png)