CBP’s Action on Giant Manufacturing and What U.S. Import Data Reveals About Bicycle Supply Chains

On September 24, 2025, U.S. Customs and Border Protection (CBP) issued a Withhold Release Order (WRO) against Giant Manufacturing Co. Ltd., citing evidence of forced labor in the company’s Taiwan operations. The order immediately requires CBP to detain imports of Giant bicycles, bicycle parts, and accessories at all U.S. ports of entry. While this action directly targets Giant, it also raises broader questions about which U.S. companies have relied on Giant’s suppliers and how far this network extends into American trade flows.

Using Vizion’s TradeView platform, we linked Giant’s DUNS numbers to its listed Taiwanese suppliers and cross-referenced those suppliers against U.S. import data. This analysis confirms Giant’s role as an importer and also identifies other consignees sourcing from the same suppliers. The findings provide a clearer picture of the potential ripple effects of CBP’s enforcement action and show how closely Giant’s supply chain is connected to the broader U.S. bicycle and sporting goods market.

Who Else Imports from Giant’s Suppliers?

By tracing Giant’s DUNS-linked Taiwanese suppliers across U.S. import records, we identified a group of other importers that also sourced from these suppliers between January and September 2025. While Giant itself remains a top importer, the list shows clear overlap with other well-known bicycle brands and distributors:

- Giant Bicycle Inc

- SRAM LLC

- Quality Bicycle Products

- Scott USA Inc

- Santa Cruz Bicycles LLC

- Hawley Nevada LLC

- Backcountry.com LLC

- Ibis Cycles Inc

Alongside these U.S. companies, Giant Bicycle Canada Inc also appears in the data, which means Giant’s supplier network extends beyond the U.S. into the Canadian market. The presence of both U.S. and Canadian entities suggests that the effects of CBP’s Withhold Release Order could reach across North America.

Post–July 1 Activity

When we narrow the dataset to the period after July 1, 2025, the picture changes considerably. Despite the looming enforcement risks, only three importers continued to bring in shipments from Giant’s Taiwanese suppliers at volumes above 3 TEUs:

- Giant Bicycle Canada Inc (Canada)

- SRAM LLC (U.S.)

- Giant Bicycle Inc (U.S.)

This sharp reduction indicates that many of the other importers active earlier in the year either paused shipments, shifted to alternative suppliers, or scaled back volumes in anticipation of increased scrutiny. The remaining activity points to risk now being more concentrated around Giant’s own products and parts, with only limited exposure across the broader U.S. dealer and distributor landscape.

Shifts in Supplier Networks Since 2020

Looking back to 2020, the list of major importers tied to Giant Manufacturing looked very different. Trek and Scott USA were once significant buyers, but both have since diversified their supplier networks, with a large portion of production now based in Asia. This reflects a broader industry trend toward geographic diversification in response to cost pressures, trade policy risks, and compliance concerns.

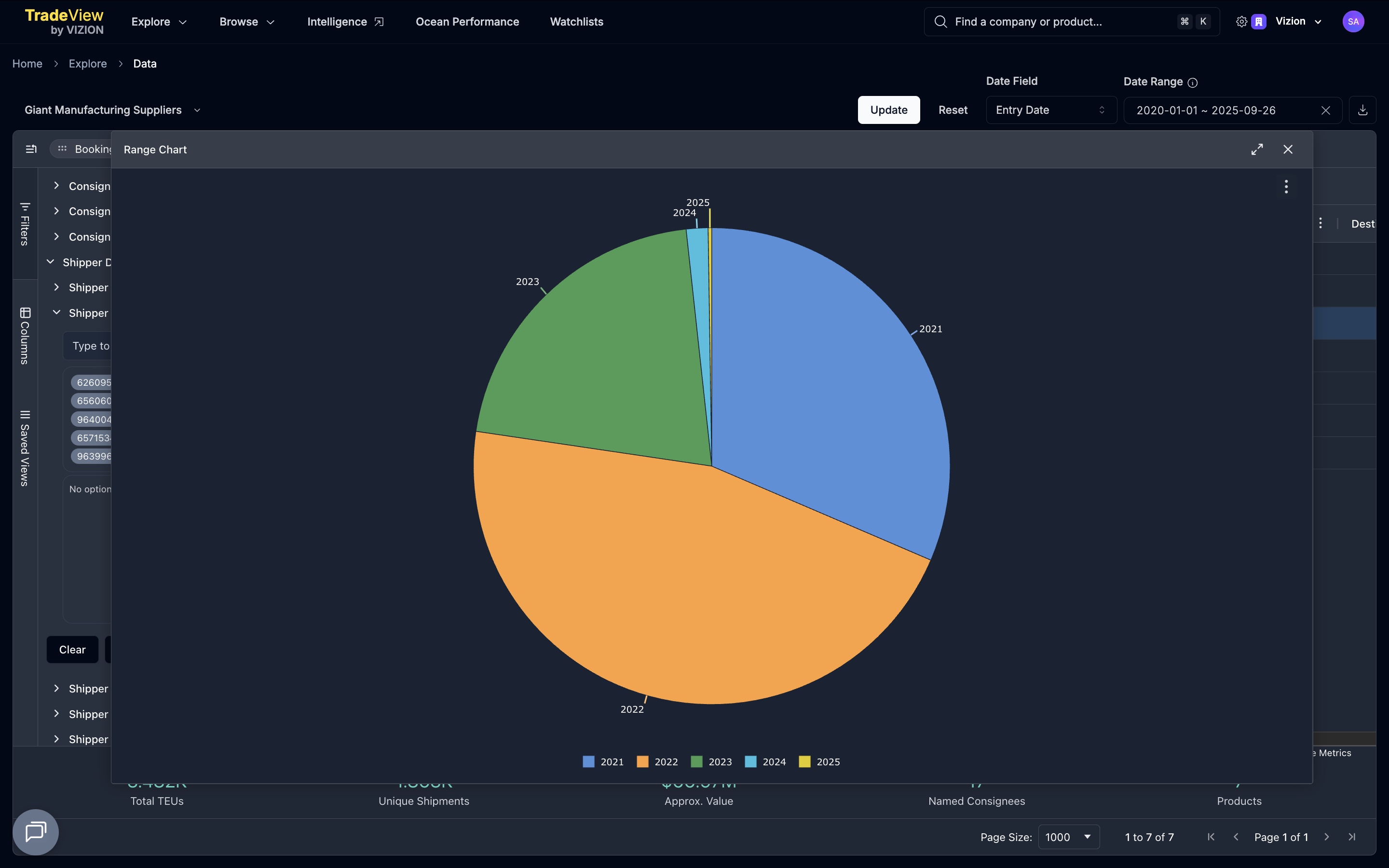

Inside Vizion’s TradeView Platform: TEU Volumes from Giant’s Suppliers Show a Sharp Drop

Conclusion

CBP’s Withhold Release Order against Giant Manufacturing shines a spotlight on the hidden risks within global supply chains. While Giant remains directly in focus, our analysis shows that multiple U.S. and Canadian companies are also linked to the same supplier network. At the same time, some of the world’s largest bicycle brands have already diversified away from Taiwan in recent years. These shifts highlight how quickly sourcing strategies can change in response to trade enforcement, tariffs, and compliance concerns.

With Vizion’s TradeView platform, these trends can be tracked in real time. The platform makes it possible to identify companies linked to specific suppliers and to spot early shifts in sourcing patterns across different countries.

👉 Request access to TradeView today to explore these trends, fact-check market headlines, and gain visibility into the supply chains that shape global trade.

%20(49).png)

%20-%202025-12-03T153209.004.png)

%20-%202025-12-03T102433.766.png)

.png)